ACQUISITIONS OF LATAM STARTUPS

- Fernanda Bezerril

- May 23, 2024

- 1 min read

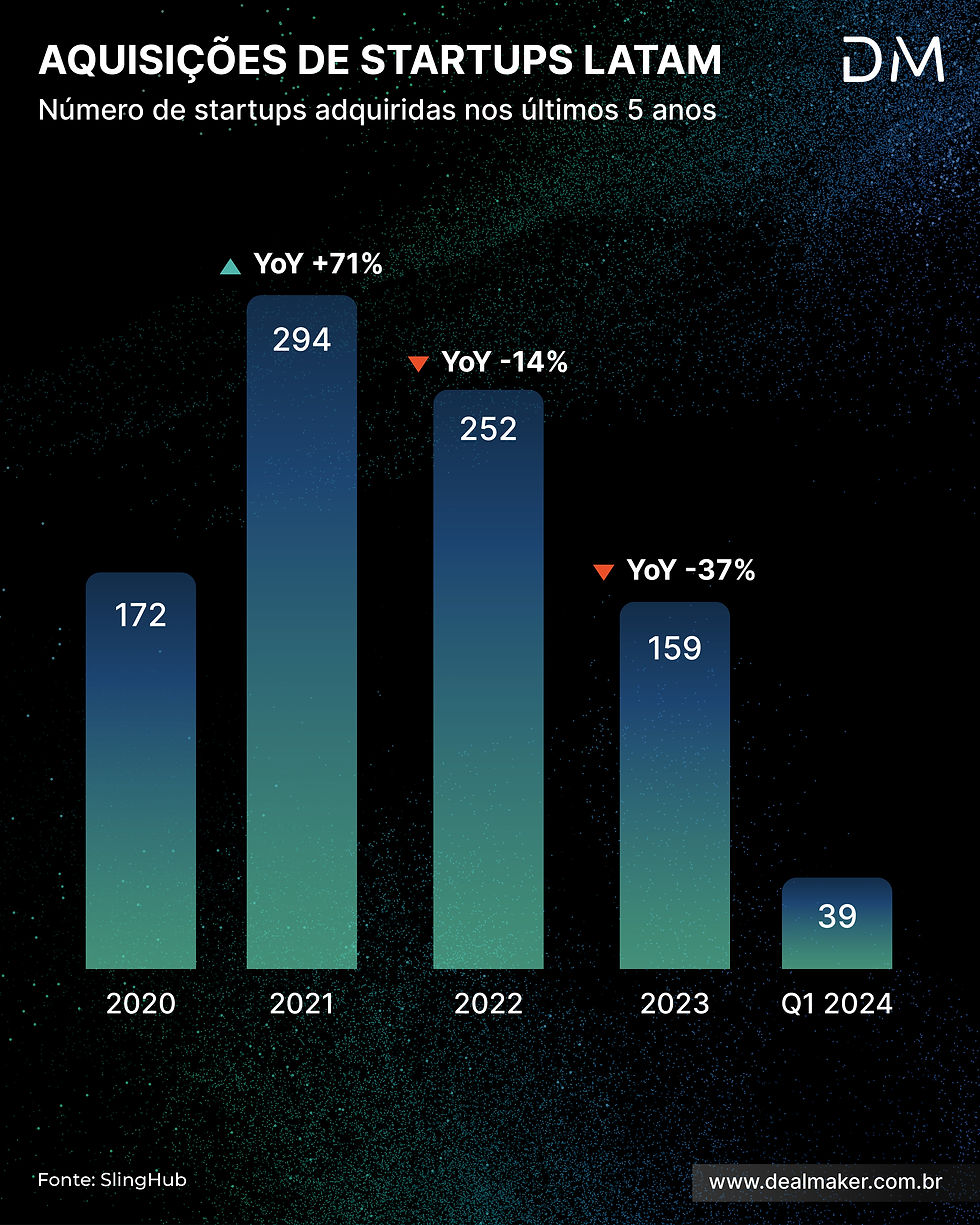

After a surge during the Covid-19 pandemic, when acquisitions of Latin American startups grew by more than 70% from 2020 to 2021, these transactions have become less attractive.

The following year, the market witnessed a 14% drop, followed by an even steeper decline of over 35% last year.

The downward trend has affected both corporations and startups - however, acquiring startups now have a larger share of the market. In 2020, they represented less than 28% of startup buyers in Latin America. Three years later, almost half of the startups sold in the region were acquired by other startups.

In the first quarter of the year, almost 40 startup acquisitions were recorded in the region, a 37% drop compared to the first quarter of 2023. Of these transactions, 48% were carried out by acquiring startups, maintaining a similar proportion year on year.

During the period, the startups with the greatest appetite were Modalmais and nuvini (7 acquisitions each), until they went through M&A processes with corporations. Modalmais was acquired by XP Inc. in 2022, while nuvini finalized its merger with Mercato in 2023.

By DealMaker Insights | Dealmaker